by Calculated Risk on 10/27/2025 02:41:00 PM

From J.D. Power: October New-Vehicle Sales Decline as EV Pull-Ahead Reverses; EV Share Falls to 5.3% Following Incentive Expiration Brief excerpt:

Total new-vehicle sales for October 2025, including retail and non-retail transactions, are projected to reach 1,249,800, a 6.9% decrease year-over-year, according to a joint forecast from J.D. Power and GlobalData. October 2025 has 27 selling days, the same as October 2024.

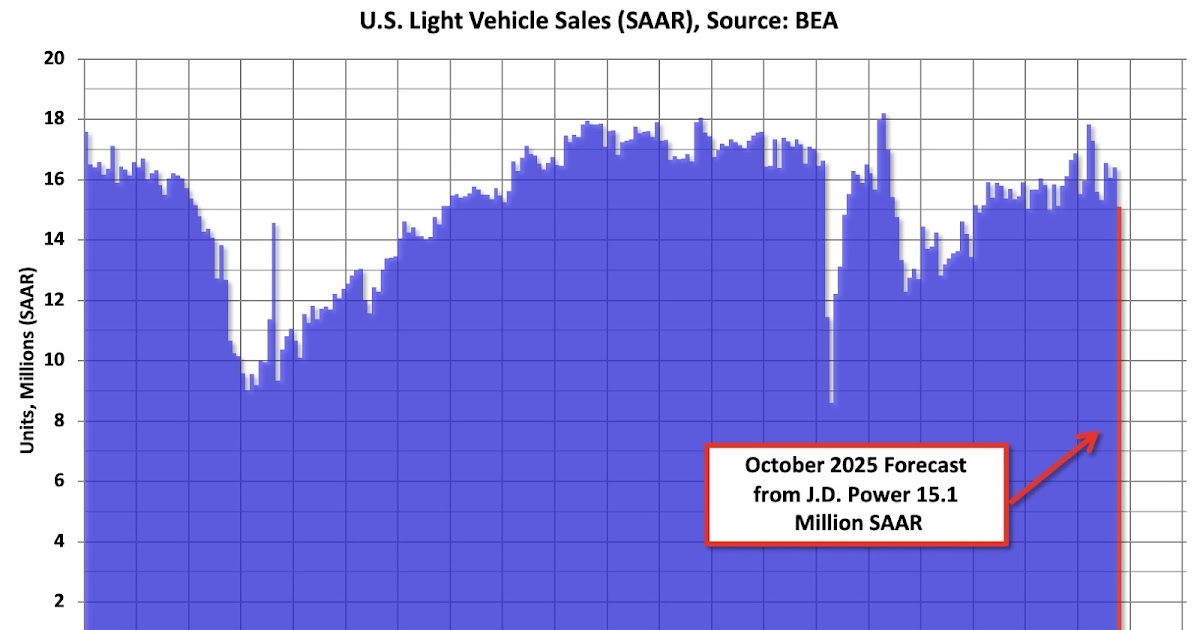

The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 15.1 million units, down 1.1 million units from October 2024.

…

Thomas King, president of the data and analytics division at J.D. Power:“October’s results reflect a notable, but expected decline in the new-vehicle sales pace, due almost entirely to sales of electric vehicles.

“The expiration of federal EV credits on Sept. 30 caused EV shoppers to pull ahead their purchases, driving a significant increase in EV sales and inflating the overall industry sales pace. In September, EVs accounted for 12.9% of new-vehicle retail sales, the highest ever, and well above the 8.5% recorded a year earlier. Now that the federal EV credit has expired, the industry is dealing with the consequences of those accelerated purchases. In October, EVs represent just 5.2% of new-vehicle retail sales. On a volume basis, EVs account for 1.0 million of the 1.2 million-unit decline in the industry sales pace compared with a month ago.

emphasis added

From Haig Stoddard at Omdia (pay site): Forecast Decline in October US Light Vehicle Sales Likely to Continue in November, December

US light vehicle sales are forecast to decline 3.6% year-over-year in October, only the second downturn this year. However, downturns are forecast to continue due to lean inventory, a rising mix of higher priced vehicles, and the end of the EV credit.

Click on graph for larger image.

Click on graph for larger image.

This graph shows actual sales from the BEA (Blue), and J.D. Power’s forecast for October (Red).

On a seasonally adjusted annual rate basis, the J.D. Power forecast of 15.1 million SAAR would be down 7.9% from last month, and down 6.3% from a year ago.

All of Q4 will likely be difficult for vehicle sales.