by Calculated Risk on 10/23/2025 02:49:00 PM

Hotel occupancy was weak over the summer months, due to less international tourism. The fall months are mostly domestic travel and occupancy is still under pressure!

The U.S. hotel industry reported mixed year-over-year comparisons, according to CoStar’s latest data through 18 October. …

12-18 October 2025 (percentage change from comparable week in 2024):

• Occupancy: 68.5% (-2.4%)

• Average daily rate (ADR): US$173.14 (+1.7%)

• Revenue per available room (RevPAR): US$118.65 (-0.7%)

emphasis added

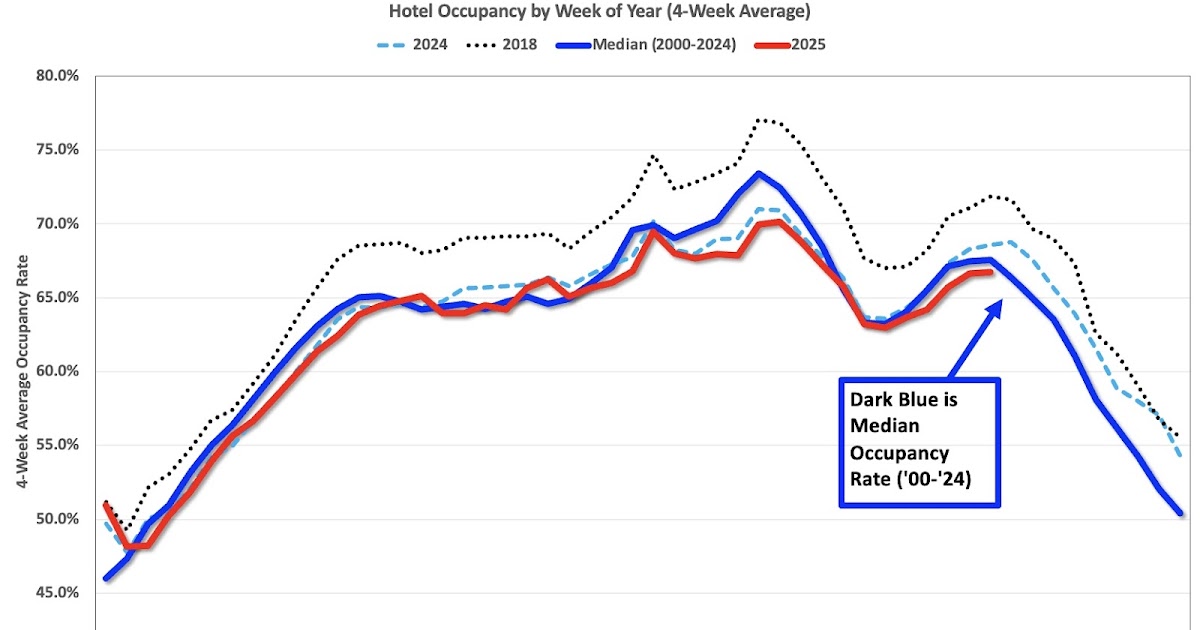

The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2025, blue is the median, and dashed light blue is for 2024. Dashed black is for 2018, the record year for hotel occupancy.

The 4-week average of the occupancy rate is tracking behind both last year and the median rate for the period 2000 through 2024 (Blue).

Note: Y-axis doesn’t start at zero to better show the seasonal change.

The 4-week average will decrease seasonally until early next year.

On a year-to-date basis, the only worse years for occupancy over the last 25 years were pandemic or recession years.

Here are some Hotel executive comments from a recent conference: ‘Uncertainty is bad for business’: Hotel executives express discontent with unpredictability

“What’s tough on our industry always is uncertainty,” said Joe Berger, president and CEO of BRE Hotels & Resorts. “It’s been a tough year to navigate.”

Leeny Oberg, chief financial officer and executive vice president of development at Marriott International, said there’s frequently a new tariff announcement or comment made toward another country that is affecting the planning process. That process is very sequential, so the timing of some of these announcements can really throw off the execution of hotel projects midway through, she said.

“You’ve got all these people trying to make plans about their cutbacks and what they’re trying to do with their properties, and it’s literally every week or every day there’s a new announcement. ‘Oh, it’s furniture today,’ or, ‘Oh, it’s this country today.’ From a planning perspective, it makes it extremely difficult,” she said.

One of the larger subplots of the year has been the decline in Canadian travel to the U.S., due in large part to comments made from President Donald Trump on America’s neighboring country. In August, Tourism Economics projected a 20.2% decline in Canadian travel to the U.S. on the year.