by Calculated Risk on 12/24/2025 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

ortgage applications decreased 5.0 percent from

one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage

Applications Survey for the week ending December 19, 2025.The Market Composite Index, a measure of mortgage loan application volume, decreased 5.0 percent on

a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 6

percent compared with the previous week. The Refinance Index decreased 6 percent from the previous

week and was 110 percent higher than the same week one year ago. The seasonally adjusted Purchase

Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent

compared with the previous week and was 16 percent higher than the same week one year ago.“Overall mortgage application volume fell last week, despite the slight decline in mortgage rates,” said

Mike Fratantoni, MBA’s SVP and Chief Economist. “MBA expects the trends of a softening job market,

sticky inflation, elevated home inventories, and steady mortgage rates will persist into the new year.”Added Fratantoni, “Purchase application volume last week was 16 percent higher than a year earlier. We

are forecasting continued, modest growth in terms of home sales in 2026.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances

($806,500 or less) decreased to 6.31 percent from 6.38 percent, with points decreasing to 0.57 from 0.62

(including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

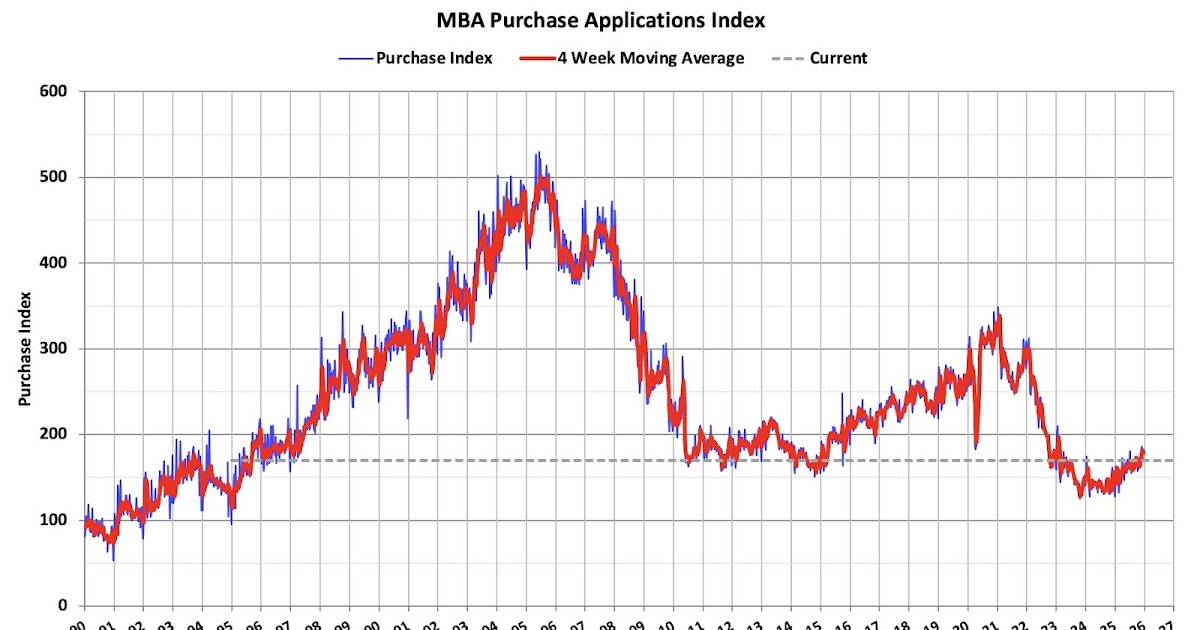

The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 16% year-over-year unadjusted.

Red is a four-week average (blue is weekly).

The refinance index increased from the bottom as mortgage rates declined, but is down from the recent peak in September.