by Calculated Risk on 9/29/2025 08:38:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hold Flat to Start New Week

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hold Flat to Start New Week

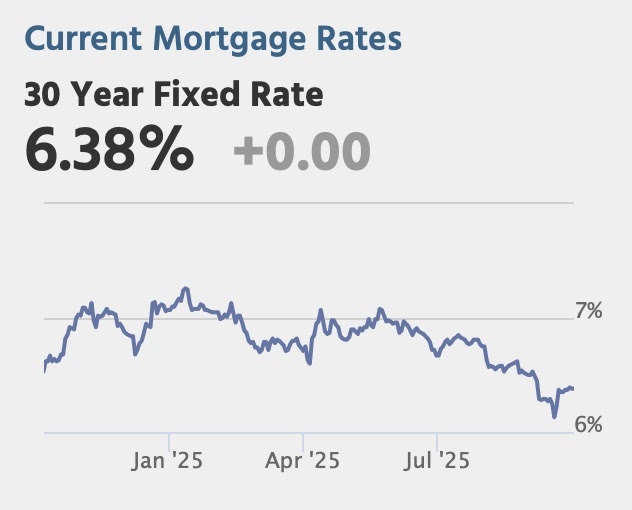

It was an uneventful day for the bond market (and, thus, interest rates) as investors wait for clarity on this week’s potential government shutdown. It’s not the shutdown itself that would notable. Rather, it would be the absence of this Friday’s jobs report (published by the Federal government) as it would deprive the rate market of its brightest guiding light.

In the bigger picture, after last month’s jobs report helped usher rates to the lowest levels in nearly a year, other economic reports gradually pushed back in the other direction. With the labor market showing some signs of potential weakness, each new jobs report will be critical in determining if there will be additional runs toward new long-term lows.

Even a stop-gap/short-term funding bill would be sufficient. The deadline for a decision is 12:01am ET on Wednesday morning. [30 year fixed 6.38%]

emphasis added

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for July. The consensus is for a 2.3% year-over-year increase in the National index for July.

• Also at 9:00 AM, FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:45 AM, Chicago Purchasing Managers Index for September. The consensus is for a reading of 43.0, up from 41.5 in August.

• At 10:00 AM, Job Openings and Labor Turnover Survey for August from the BLS.