by Calculated Risk on 11/04/2025 11:08:00 AM

Today, in the Real Estate Newsletter: House Prices to Income

Brief excerpt:

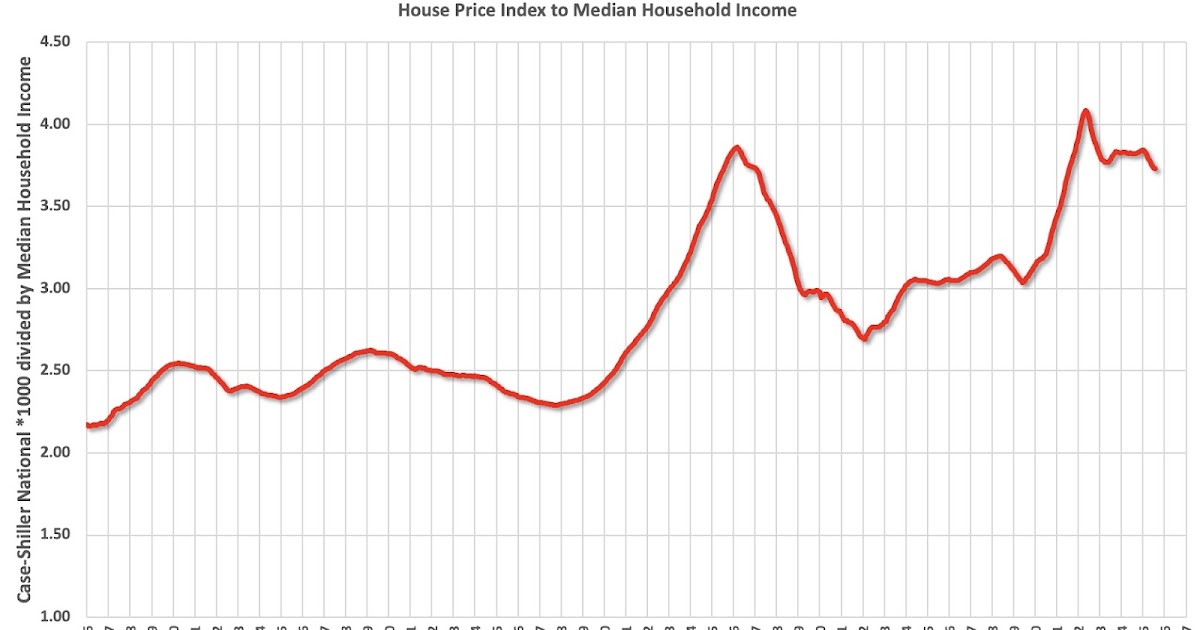

One of the metrics we’d like to follow is a ratio of house prices to incomes.

Unfortunately most income data is released with a significantly lag, and there are always questions about which income data to use (the average total income is skewed by the income of a few people).

And for key measures of house prices – like Case-Shiller – we have indexes, not actually prices. But we can construct a ratio of the house price indexes to some measure of income.

…This graph uses the year end Case-Shiller house price index – and the nominal median household income through 2024 from the Census Bureau. 2025 median income is estimated at a 4% annual gain.

By this measure, house prices are 3% below the bubble peak, and about 9% below the recent peak.

There is much more in the article.

This graph uses the year end Case-Shiller house price index – and the nominal median household income through 2024 from the Census Bureau. 2025 median income is estimated at a 4% annual gain.

This graph uses the year end Case-Shiller house price index – and the nominal median household income through 2024 from the Census Bureau. 2025 median income is estimated at a 4% annual gain.