by Calculated Risk on 11/25/2025 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September (“September” is a 3-month average of July, August and September closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P Cotality Case-Shiller Index Records Annual Gain in September 2025

• The S&P Cotality Case-Shiller U.S. National Home Price NSA Index posted a 1.3% annual gain

for September, down from a 1.4% rise in the previous month.• Inflation outpaced home prices for a fourth straight month, with September’s CPI running 1.7

percentage points above housing appreciation—the widest gap since the measures began

diverging in June.• All 20 metros recorded month-over-month declines before seasonal adjustment in September,

underscoring broad-based weakening as elevated mortgage rates weigh on affordability and

demand.S&P Dow Jones Indices (S&P DJI) today released the September

2025 results for the S&P Cotality Case-Shiller Indices.Please note that September 2025 transaction records for Wayne County, MI, are delayed at the local

recording office. Since Wayne is the most populous county in the Detroit metro area, Cotality is not able

to generate a valid September 2025 update of the Detroit S&P Cotality Case-Shiller Index before the

November 25, 2025, release date. …“The housing market’s deceleration accelerated in September, with the National Composite posting just

a 1.3% annual gain—the weakest performance since mid-2023,” said Nicholas Godec, CFA, CAIA,

CIPM, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices. “This marks a

continued slide from August’s 1.4% increase and represents a stark contrast to the double-digit gains

that characterized the early post-pandemic era. National home prices continued trailing inflation, with

September’s CPI running 1.7 percentage points ahead of housing appreciation. This marks the widest

gap between inflation and home-price growth since the two measures diverged in June, with the spread

continuing to widen each month.“Regional performance reveals a tale of two markets. Chicago continues to lead with a 5.5% annual

gain, followed by New York at 5.2% and Boston at 4.1%. These Northeastern and Midwestern metros

have sustained momentum even as broader market conditions soften. At the opposite extreme, Tampa

posted a 4.1% annual decline—the sharpest drop among tracked metros and its 11th consecutive

month of negative annual returns. Phoenix (-2.0%), Dallas (-1.3%), and Miami (-1.3%) likewise

remained in negative territory, highlighting particular weakness in Sun Belt markets that experienced

the most dramatic pandemic-era price surges.

…

The S&P Cotality Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census

divisions, reported a 1.3% annual gain for September, down from a 1.4% rise in the previous month.

The 10-City Composite showed an annual increase of 2.0%, down from a 2.1% increase in the previous

month. The 20-City Composite posted a year-over-year increase of 1.4%, down from a 1.6% increase

in the previous month.

…

The pre-seasonally adjusted U.S. National, 10-City Composite, and 20-City Composite Indices

continued to report negative month-over-month changes in September, posting -0.3% for the U.S.

National Index and -0.5% for both the 10-City and 20-City Composite Indices.After seasonal adjustment, the U.S. National and 10-City Composite Indices reported a monthly

increase of 0.2% and the 20-City Composite Indices posted a month-over-month gain of 0.1%.

emphasis added

Click on graph for larger image.

Click on graph for larger image.

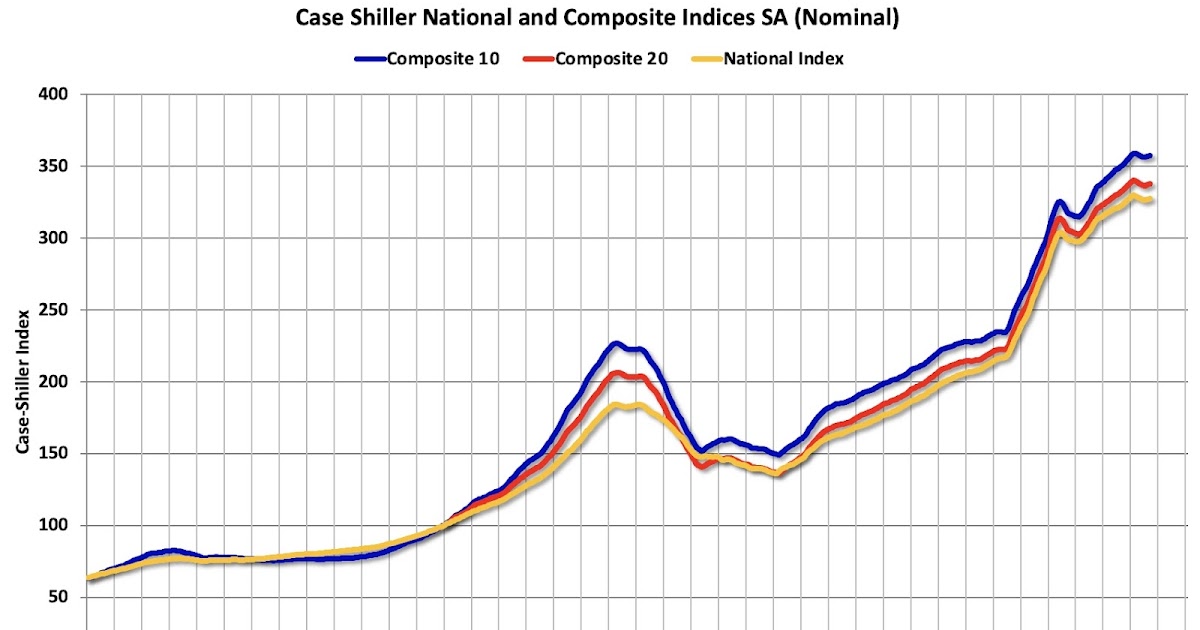

The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.2% in September (SA). The Composite 20 index was up 0.1% (SA) in September.

The National index was up 0.2% (SA) in September.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.

The Composite 10 NSA was up 2.0% year-over-year. The Composite 20 NSA was up 1.4% year-over-year.

The National index NSA was up 1.3% year-over-year.

Annual price changes were below expectations. I’ll have more later.