by Calculated Risk on 11/12/2025 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.6 percent from one

week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage

Applications Survey for the week ending November 7, 2025.The Market Composite Index, a measure of mortgage loan application volume, increased 0.6 percent on

a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 1

percent compared with the previous week. The Refinance Index decreased 3 percent from the previous

week and was 147 percent higher than the same week one year ago. The seasonally adjusted Purchase

Index increased 6 percent from one week earlier. The unadjusted Purchase Index increased 3 percent

compared with the previous week and was 31 percent higher than the same week one year ago.“Purchase applications picked up almost 6 percent over the week to the strongest pace since September,

despite mortgage rates increasing slightly, with the 30-year fixed rate rising to 6.34 percent,” said Joel

Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications for conventional, FHA,

and VA loans increased, as potential homebuyers continue to shop around, particularly in markets where

inventory has increased and sales price growth has slowed. Based on the unadjusted purchase index for

the week, this was the strongest start to November since 2022.”Added Kan, “Higher mortgage rates did quell some refinance activity, as conventional and VA refinance

applications declined over the week, and the average loan size for refinances dropped to its lowest level

in over a month.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances

($806,500 or less) increased to 6.34 percent from 6.31 percent, with points increasing to 0.62 from 0.58

(including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

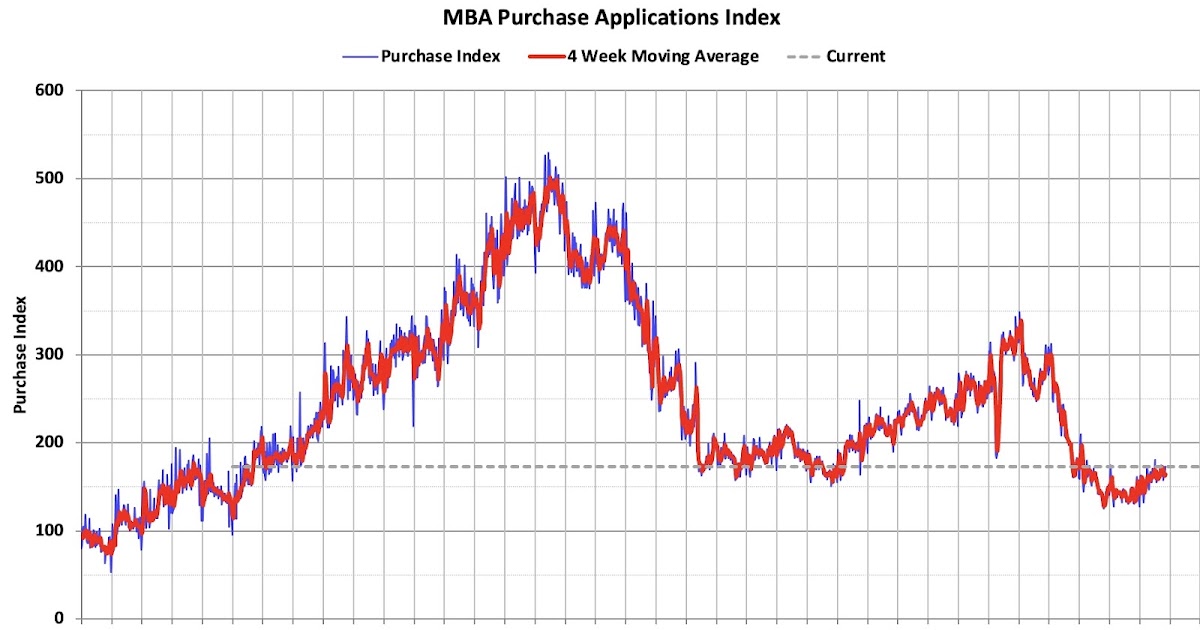

Click on graph for larger image.

The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 31% year-over-year unadjusted.

Red is a four-week average (blue is weekly).

The refinance index has increased from the bottom as mortgage rates declined.